Listen to the latest episode of Credit Exchange with Lisa Lee

Published in London & New York

10 Queen Street Place, London

1345 Avenue of the Americas, New York

Creditflux is an

company

© Creditflux Ltd 2025. All rights reserved. Available by subscription only.

Analysis Sponsored by Entegra

Liquidity Ladder: Scale may bring attention, but visibility is emerging as the currency of market liquidity

by Daniel Ezra, Founder & CEO, Entegra

In his third and final article, Daniel Ezra looks at how a CLO manager’s visibility can impact deal pricing

In our last article, Vanishing Volumes, we showed how declining trading turnover concentrated liquidity in the hands of a few, widening the divide between the largest managers and the rest. In this final instalment, Liquidity Ladder, we explore what that imbalance means in practice.

Drawing on Entegra’s study Visible Value: The Impact of Secondary Market Visibility on New Issue CLO Pricing, developed with data support from Solve, the findings show that visibility is emerging as a new form of market currency, one correlated with tighter new issue pricing and stronger perceptions of liquidity.

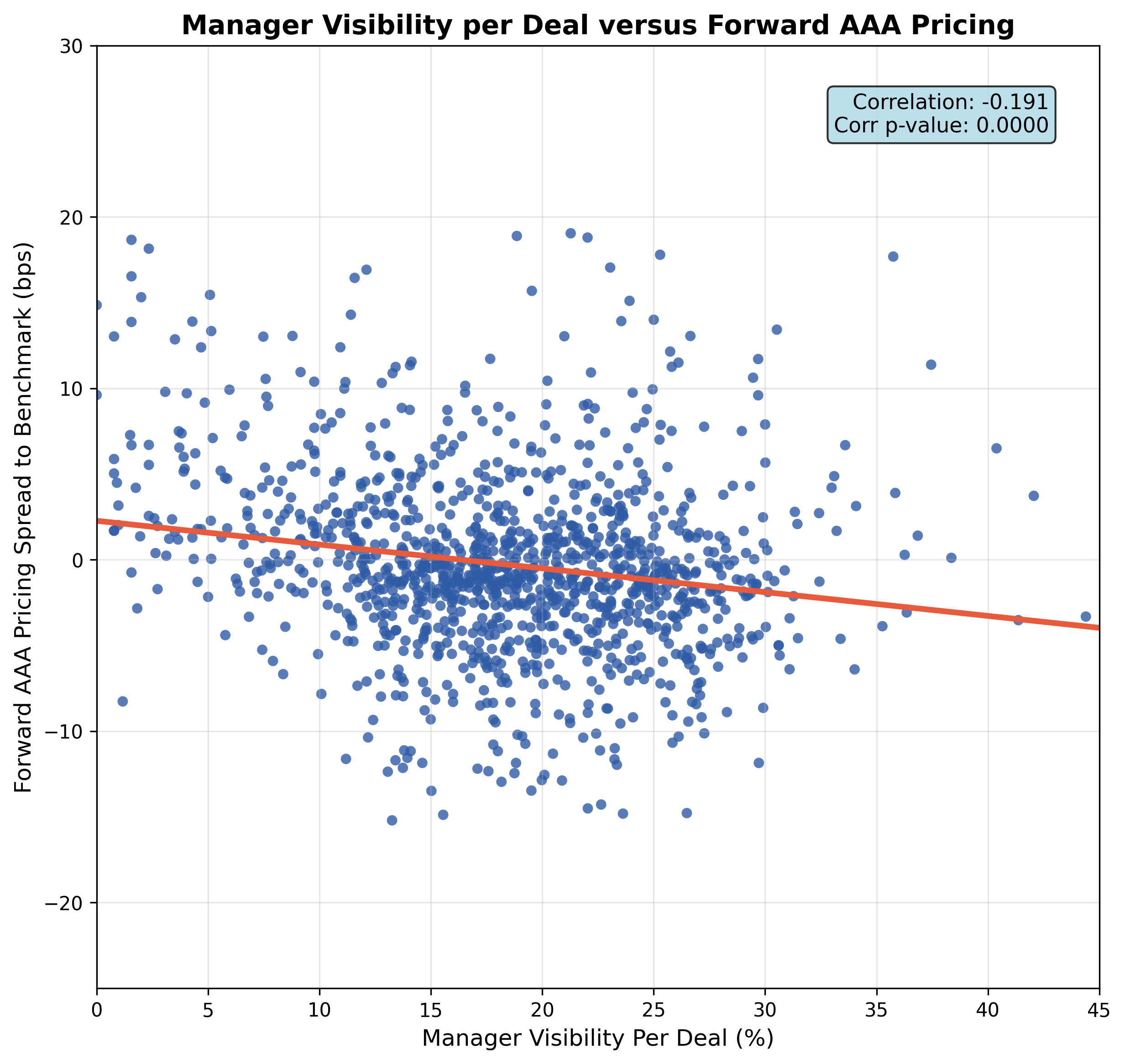

1: Correlation between visibility and future new issue pricing

Measured at the deal level and the platform level

Any skill can be developed through focus and repetition. In physical training, excellence comes from frequency, intensity, and duration, a framework known as the FITT principle. The same is true in markets, where visibility depends on those same principles. Frequency reflects how often a manager’s deals appear in the secondary market, intensity reflects how broad that visibility is across their platform, and duration reflects how long that visibility persists. Where arrangers once supplied visibility by default, managers today must build it by design.

In Disappearing Dealers (Creditflux, August), we showed how banks’ retreat from trading led them to step back from providing secondary market support for the very deals they bring to market, a change managers and investors have come to accept as normal. Like a frog in slowly boiling water, managers have accepted that scale begets service, often without realizing how much steeper the climb toward secondary market visibility has become. Analysis from Entegra’s study with Solve shows that this visibility correlates meaningfully with forward pricing performance of a manager’s new issue CLO transactions.

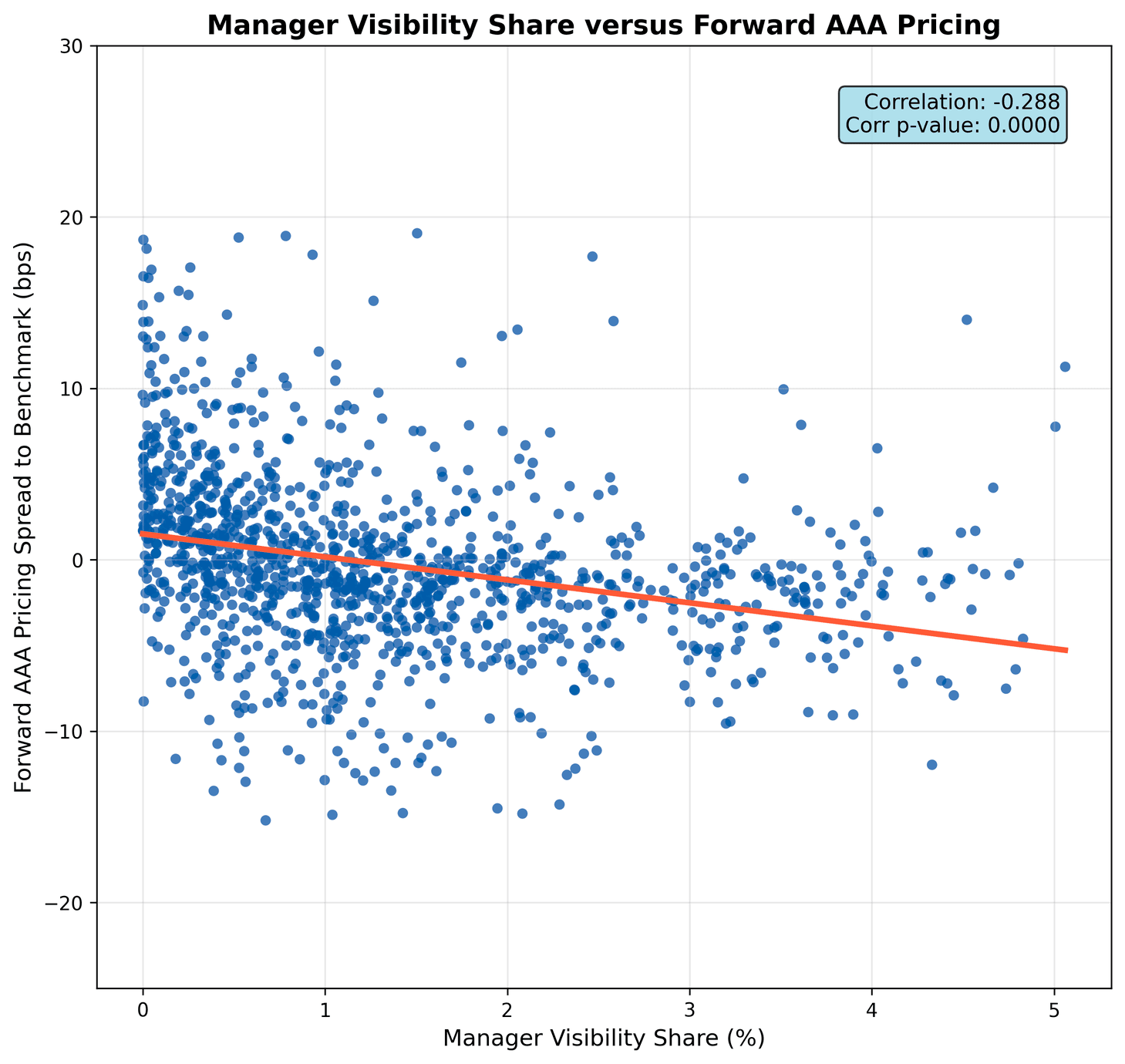

2: Aggregate Visibility of CLO Managers from Issuance

Comparing duration of visibility for managers pricing above and below the average — 2020 to present

The results in chart 1 make the pattern clear. Visibility per deal shows roughly a 20% correlation with tighter new-issue pricing, while daily visibility across a manager’s entire platform strengthens that relationship to around 30%. The data shows that visibility at scale matters even more than visibility in isolation. Simply put, frequency matters, but frequency and intensity together matter more.

While frequency and intensity capture the initial burst of market attention, the final piece of the puzzle is duration, the ability to sustain visibility across a deal’s lifecycle. Most managers issue new transactions roughly once a quarter, yet the data show that visibility often fades just after the next deal comes to market. That gap matters. The managers which can maintain visibility between offerings give investors a consistent reference point and keep their platforms front of mind even when they are not issuing.

As chart 2 illustrates, managers whose deals priced tighter than the benchmark maintain higher average visibility throughout the life of the deal, while those that priced wider lose visibility over time. This divergence becomes clear over months, not days. Each step down in the blue line represents roughly one trading month, and by the one year mark — about 250 business days — the visibility gap is well established. The average AAA spread differential between the two groups is roughly 8 basis points, underscoring that deals which price tighter at launch also sustain stronger visibility in the secondary market. The liquidity perception advantage compounds the longer a deal stays active in the secondary market.

Visibility builds credibility, credibility attracts liquidity, and liquidity creates pricing power.

Daniel Ezra

Founder & CEO, Entegra

That advantage has real consequences. As new CLOs come to market, investors in the previous deal often sell their holdings to participate in the next. Managers with sustained visibility give those investors the liquidity they need to roll seamlessly from one transaction to another, reinforcing demand for future issuance and creating a cycle of confidence and pricing strength.

For others, the opposite occurs: when visibility fades, liquidity thins, and investors struggle to exit old positions. The result is a self-reinforcing loop where weaker visibility leads to weaker liquidity, and the gap between strong and weak platforms widens with every issuance cycle.

For years, managers and investors have accepted this imbalance as structural. But it no longer needs to be. The combination of better data, electronic connectivity, and independent secondary market support is beginning to reshape what visibility looks like in practice. Managers that once relied solely on scale can now achieve liquidity through consistency, by remaining active, visible, and connected across the full life of their deals.

These developments mark a quiet turning point. Visibility, once a by-product of size, is emerging as a new currency of liquidity, and a strategic tool for CLO managers. When cultivated with purpose, visibility builds credibility, credibility attracts liquidity, and liquidity creates pricing power. Together, these forces form the rungs of the liquidity ladder, allowing managers to climb with purpose rather than wait for scale. In a market where size demands attention, visibility offers something more lasting: the ability to tighten pricing, enhance performance, and scale a platform.

If Disappearing Dealers traced the retreat of market liquidity and Vanishing Volumes examined how it concentrated at the top, Liquidity Ladder shows that visibility may now be the framework for its return.

About Entegra’s Trading as a Service (TaaS)

Visibility no longer has to take years to build. TaaS facilitates daily secondary market support that sustains a deal’s visibility across its lifecycle, at no cost to the CLO manager. This is funded by the arranger as part of the primary mandate to ensure that deal support continues long after issuance. TaaS is a mode of exposure that helps managers stay visible between offerings, improve execution for investors, and strengthen future pricing power.

Entegra is offering a free visibility report to CLO managers: Email info@entegra-global.com to request yours.