Listen to the latest episode of Credit Exchange with Lisa Lee

Published in London & New York

10 Queen Street Place, London

1345 Avenue of the Americas, New York

Creditflux is an

company

© Creditflux Ltd 2025. All rights reserved. Available by subscription only.

News

Managers sweeten deals on US captive CLO equity funds to get investors in the door

by Lisa Fu

Managers seeking to raise captive CLO equity funds in the US are adding a range of sweeteners — from fee discounts to new structures — in a bid to attract investor capital.

For a CLO manager, there’s a strong incentive to raise a captive CLO equity fund. These vehicles give managers control over when they issue a deal, especially during periods of market volatility when opportunities open but outside equity investors may be skittish.

“The market is quite crowded right now,” one CLO equity investor said. “It is difficult, particularly for first-time managers, to differentiate and substantiate their competitive advantages.”

But while more managers are looking to raise captive equity, there is a limited pool of money that any one investor can give to an asset class like CLO equity. That has given investors an upper hand when negotiating fees and terms, and some managers are seeking to differentiate themselves with better economics and alignment.

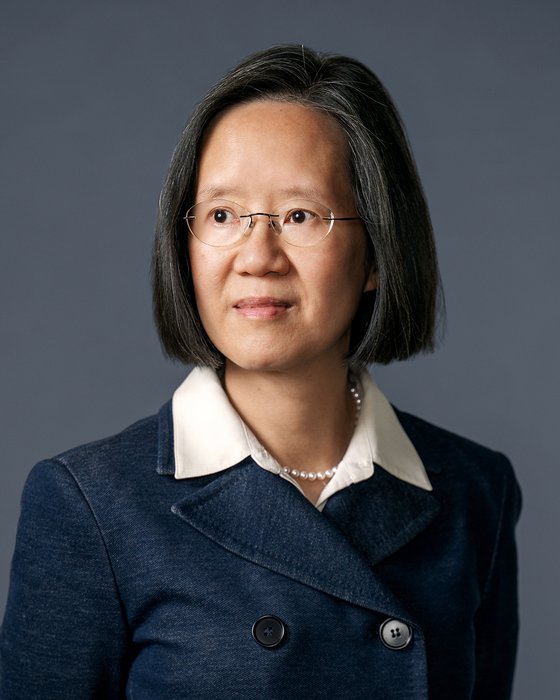

What a manager is willing to offer the investor really depends on where they are in their life cycle, said Tram Nguyen, a partner in Mayer Brown’s corporate and securities practice in Washington DC. A large manager expanding into CLO equity after already owning a longstanding CLO platform will think differently about the economics compared to a manager trying to get off the ground.

People are getting creative to align investor and manager expectations

Tram Nguyen

Partner

Mayer Brown

Funds for new platforms typically offer benefits to anchor investors. Early investors that provide a big ticket might get a revenue share or a size-based benefit relative to other investors, Nguyen said.

Most US captive CLO equity funds already offer little or no fees, instead passing through the fees from the level of the CLOs. But to incentivise investors, many managers are refunding those CLO-level fees.

In the current market, fees at the CLO level land between 35bps to 50bps on the equity, according to Lindsay Trapp, a partner in Dechert’s structured credit and CLO group. Managers will pass through those fees to the fund, then apply a rebate — essentially paying back fund investors some of the combined CLO senior and subordinate management fees. Alternatively, the manager can cap the amount of fees that will be passed through to the fund.

“We’ve had some people give extraordinarily large rebates because they’re trying to set up their first fund,” Trapp said. Additional rebates based on cheque size or investors coming in early can also be offered.

Other US captive CLO equity funds may charge a more typical management fee and an incentive fee at the fund level, instead of passing through the fees from the CLO level.

Firms are often willing to negotiate side letter provisions, and this can include fee breaks, Trapp said.

Many sophisticated LPs are alive to the fact that a lot of captive funds bury higher fees into their underlying CLOs than they would be able to source from third-party investors, the CLO equity investor said. These funds are positioned as zero or low fee funds and waive away the potential conflicts of interest and the constrained investible universe.

“People are trying to be creative in looking for economics that align investor expectations with that of the manager,” Nguyen said. This phenomenon has become more noticeable over the past 12 months and is one way to get investors comfortable with committing capital to the fund.

Some managers are structuring funds where investors get paid before the manager. Other investors invest in exchange for a revenue share of the larger platform, rather than just in the next few vehicles.

Managers also incentivise investors to commit capital by offering co-investment opportunities. If the fund has hit its capacity, co-investing allows the investor to get more exposure to the asset class, Nguyen said.