February 2022 | Issue 242

News

Migration into floating rate kicks off with record loan inflows

Migration into floating rate kicks off with record loan inflows

Hugh Minch

Reporter

The leveraged loan market received record-breaking inflows from retail funds in January as investors pivoted into floating rate products in advance of interest rate rises, according to market sources.

Retail fund inflows were $2.25 billion in the week beginning 14 January, the largest figure on record, while the prior week saw the highest flows since 2013, at $1.9 billion.

Meanwhile, there are thought to be upwards of 200 CLO warehouses open, and the high bid for assets is pushing prices up in the secondary market.

“There’s a lot of capital sitting on the sidelines, which is why everything is as well bid as it is in secondary,” says Young Choi, partner at King Street Capital Management. “On the new issue side, unless you’re bringing a very challenged loan, everything is very oversubscribed.”

Technical and fundamental factors bode well for the CLO market in 2022, with liability spreads likely to tighten in line with the loan market in the near term.

“CLOs are always in a push and pull with the loan market,” says Choi. “Loans are pricing tight and will challenge the arb to a certain extent, so you would expect liabilities to tighten as well.”

“Loans are pricing tight and will challenge the arb”

Young Choi, Partner | King Street Capital Management

Demand for loans is likely to translate into a high rate of loan refinancing in 2022, a risk factor that was not present in 2021 when loans largely traded below par.

Most analysts are forecasting defaults to remain low through the year, which is another factor bringing loans and CLOs to the attention of a wider investor base.

“It’s likely that overall CLO volumes are going to be slightly down from last year, but demand will be up,” says Tricia Hazelwood, international head of securitised products at Mitsubishi UFJ Financial Group.

“Corporate America is performing incredibly well, and there’s not much out there that yields as much as CLOs, which have performed strongly and have great returns.”

Established buyers of CLOs have expanded their investments, with US bank holdings of CLOs rising 30% in 2021, led by huge inflows from Bank of America and Wells Fargo.

Insurance companies are expected to buy more CLOs in 2022 following rule changes sanctioned by the National Association of Insurance Commissioners.

At the same time, the asset class’s performance through the covid shock has brought new institutional investor interest.

AGL Credit Management’s Wynne Comer says CLOs are now a mature asset class, and that her firm saw a “ton” of new investors in 2021.

“It seems like on every transaction there’s somebody new that we haven’t met before,” Comer says. “The CLO market is too big to ignore at this point.”

The Federal Reserve is widely expected to raise rates when it meets in the coming days after Creditflux goes to press.

Goldman Sachs analysts are anticipating four rate rises in 2022, while analysts at MUFG expect two rate rises this year.

Advertisement

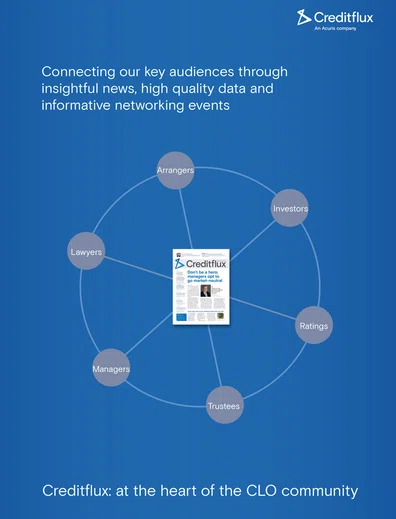

Global credit funds & CLO's

February 2022 | Issue 242

Published in London & New York.

Copyright Creditflux. All rights reserved. Check our Privacy Policy and our Terms of Use.