Listen to the latest episode of Credit Exchange with Lisa Lee

Published in London & New York

10 Queen Street Place, London

1345 Avenue of the Americas, New York

Creditflux is an

company

© Creditflux Ltd 2025. All rights reserved. Available by subscription only.

News

News in brief

Stress in good quality companies opens up opportunities

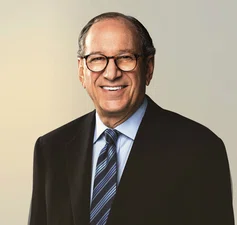

Businesses that took out debt during a bygone era of zero interest rates are beginning to buckle, creating openings in opportunistic credit, said Alan Schrager, senior partner at Oak Hill Advisors, on the Credit Exchange podcast with Lisa Lee in September.

“There are nuggets of opportunity in decent companies that have run their course with the leverage levels they have,” said Schrager. He believes there is an opening for credit managers to buy syndicated debt at a discount — or provide new debt to help with refinancings or restructurings that will reorganise balance sheets.

This strategy is a shift from earlier this year, when Schrager said on a February podcast episode that “going upmarket” to find lower risk investments made more sense. The investments he favoured then were lower yielding, but he felt it was a better option to target them rather than try to find a premium by going down market because of volatility and uncertainty.

That has now changed. “The volatility is now certain,” Schrager said on the most recent podcast. The market has priced it in and there is less fear about taking on slightly riskier investments.

He said the key is to find high-quality businesses trading at a discount — or looking for incremental capital — rather than chase low-quality businesses trading at big discounts.

“We’re not necessarily macro guys,” Schrager said. “We’re going to choose good companies with good businesses and we’re going to finance them — and those should do fine through a whole cycle.”

Asia’s insurers predicted to turn to private credit for yield and quality

Domestic insurers are expected to up their investments into private credit in Asia, expanding the pool of capital that asset managers can then lend, according to Blackstone.

Creditflux spoke to Dan Leiter, head of international, and Mark Glengarry, head of APAC for private credit strategies, both at Blackstone Credit and Insurance.

“Mark and I have been spending a lot of time with our partners in Asia,” said Leiter. “Insurers have been focused on growing their allocations to private credit.”

After struggling to source worthy assets in public markets, domestic Asian insurers are seeking a channel for private assets that delivers yield plus the same high-grade quality credit, said Glengarry.

Private investment grade credit represents an attractive solution for insurers as high-grade corporate bond issuance has been limited in the region.

This is partly because the bond market in Asia skews toward real estate, and because the real estate market is grappling with significant challenges, particularly in China.

“I think APAC is probably expected to account for 40% of global insurance premiums by the end of the decade. So it’s a significant part of the global insurer market. When you look at these insurers, they are very under-allocated to private credit versus North America and the US,” said Glengarry.

Leiter added that the growth of private credit is in part a way to finance “the real economy” in Asia. “This includes infrastructure credit, real estate debt, fund finance and various types of asset-backed finance,” he said.

Top stories on creditflux.com: responses differ to European risk retention clarification

29 August

Sponsors abandon companies to private lenders at rapid rate

The first half of 2025 saw private equity sponsors hand over companies to direct lenders at a volume that exceeded the past five years combined, according to Lincoln International. Debt-for-equity swaps totalled USD 20.7bn during the period.

Ron Kahn: the co-head of Lincoln International’s global valuations and opinions group said the handover rate is “a new phenomenon that is somewhat concerning”

30 July

US private credit firm Brinley secures USD 4bn commitment from insurer

USD 1bn will fund Brinley’s inaugural CLO.

31 July

Thoma Bravo’s private credit head to depart

Oliver Thym, who has led the credit platform since 2020, will be replaced by Jeff Levin.

4 August

Blackstone readying European CLO ETF

The fund will focus on triple As.

5 August

Apollo turns away from CLOs

The CLO business has become commoditised due to easy access, CEO Marc Rowan said during the firm’s second quarter earnings call.

12 August

New headaches for European CLO market as regulators clarify risk retention guidance

The European Commission overturned widespread market practice regarding conditional sale agreements, with a new interpretation of the ‘originator’ definition under the EU Securitisation Regulation.

12 August

Executive order leaves questions around CLO adoption in 401(k)s

The US government has given the green light for 401(k)s and other defined contribution plans to invest in alternative assets. But experts are uncertain whether the move will lead to increased inflows for CLOs.

14 August

CVC raises USD 700m for CLO equity fund and plans new products

The European private credit manager also expects to hold a final close for its European Direct Lending Fund IV in late Q3.

15 August

Stubborn US CLO liability prices begin to tighten as deal supply eases

US CLO spreads have tightened markedly as a result of lessening supply, with triple As in particular showing a belated response to the broader tightening across financial markets.

19 August

Many European CLOs may have lost risk retention compliance following EBA clarification

More than 85% of manager-originator European CLOs include conditional sale agreements to transfer credit risk from the CLO to the originator, according to research published by Dealscribe.

21 August

CLO lawyers see European CLO risk retention clarification as ‘headache, not a migraine’

After initially expressing concerns, lawyers began to display a more sanguine attitude toward the updated regulation, with fixes already being implemented by affected managers.

27 August

Private credit CLOs boom to new high

As August came to a close, the middle market showed record levels of issuance, while US BSL primary activity chased 2024 levels.

Past returns

Another spike in UK gilts

Borrowing costs for the UK government have spiked to the highest rate this century. Thirty-year gilt yields hit 5.72% in September.

This surpasses the yield when former British prime minister Liz Truss’s mini-budget caused a crisis in UK liability-driven investments that was only staved off by the intervention of the Bank of England.

At the time, Apollo purchased USD 1.1bn of triple As and double As from pension funds looking for liquidity. The US asset manager made a winning bet — and its massive purchases highlighted the liquidity of CLOs.

Points up front

Return of the bond vigilantes

‘Bond vigilantes’ are back and protesting once again against Western governments’ inability to reign in spending.

Governments in western Europe and the US are struggling to contain growing piles of debt that fund everything from defence and welfare to tax cuts. Investors, particularly large, sophisticated investment funds, appear to be losing faith in their policies and are selling off sovereign bonds to indicate their withdrawal of support.

In some Euro-denominated countries, investment funds hold as much as a quarter of outstanding government debt, according to the European Central Bank. So when these institutions adjust portfolios en masse, the impact can rattle bond markets. Governments that rely on this sovereign debt to finance their budgets may be compelled to listen.

Already, the US, UK, Italy and France have seen falling bond prices and higher yields as investment funds seek to lower their exposure to countries they now find less stable. Yields on 30-year UK gilts reached the highest level since 1998 in early September as concerns around the autumn budget grew and US courts fought over the legality of US tariff policy.

Meanwhile, French lawmakers ousted a second prime minister in less than a year, just as Creditflux goes to press.

Money is seemingly talking as loud as only it can.

Protest: there’s no need to take to the streets when you own a government’s bonds