Opinion

April 2022 | Issue 244

Past returns

Highland’s Brazilian ‘CLO’

In Creditflux 10 years ago, we reported that Highland Capital Management was launching a regulated fund backed by Brazilian credit in a tranched structure consisting of senior debt and equity.

The deal, an FIDC (Fundos de Investimento em Direitos Creditorios), is similar to a CLO. It is run by Highland’s Brazilian affiliate, Highland Capital Brasil Gestora de Recursos, which invests in Brazilian infrastructure, distressed and corporate loans.

Creditflux reported last month that Stepstone Group had established a securitisation in Mexico.

Points up front

Same building, different rules at Credit Suisse

If market participants needed confirmation that the banking and asset management arms of Credit Suisse operate independently, then the opening panel at Creditflux’s US CLO Summit last month seemed to provide it.

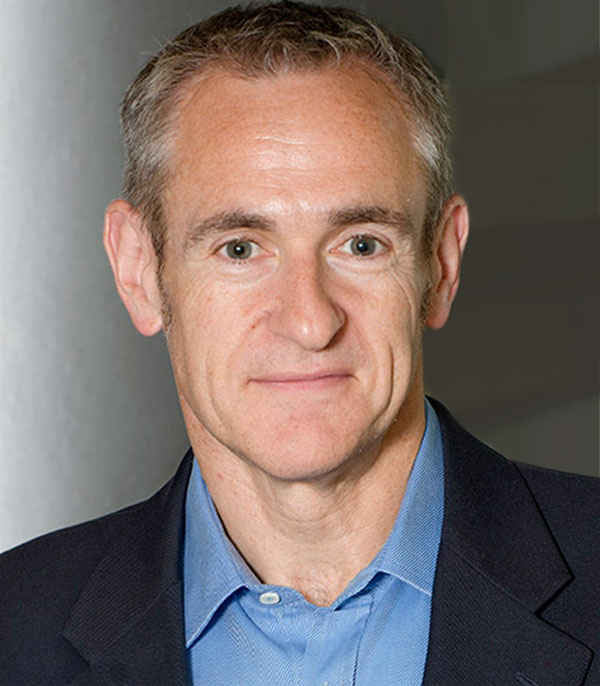

Amir Vardi, Credit Suisse Asset Management’s head of structured products, and Brad Larson, head of new issue CLOs at Credit Suisse, were in fine form for the panel discussion in New York.

Vardi introduced himself as working “on the other side of the house, same building though” to Larson. When the topic of the SEC’s proposed private fund reporting rules popped up, Vardi cautioned that he had been instructed by his firm not to comment on the regulation.

However, when Larson took his turn he quipped: “I was not asked not to comment on the SEC, but maybe I shouldn’t.”

Sometimes, you don’t need to get the memo... to get the memo.

At Credit Suisse, Vardi (left) and Larson are on ‘opposite sides of the house’. But on the state of the market panel they got to compare memos about the SEC.

Celebrating par — that definitely isn’t par for the course

The head of securitised credit at Schroders, Michelle Russell-Dowe, recently posted on LinkedIn that her grandmother had turned par (100 years old).

The post stated that Ms Russell-Dowe is “now a premium, with 101 handle”. We would like to send her our congratulations — and wish her many happy returns.

THEY SAID IT

“I feel vindicated and proud to have fought for over 10 years on behalf of investors”

Dallas-based Patrick Daugherty says “it was worth it”, after his settlement with Highland, which he left amid disagreements in 2012. He is awarded an ownership interest in the Highland platform, complete ownership of two Highland affiliates and a lump sum payment.

Global credit funds & CLO's

April 2022 | Issue 244

Published in London & New York.

Copyright Creditflux. All rights reserved. Check our Privacy Policy and our Terms of Use.