Opinion

February 2021 | Issue 231

Past returns

Nochu lands in Europe

Five years ago in Creditflux, we reported that Norinchukin Bank had made its first investment in a 2.0 European CLO. This was a milestone as Norinchukin’s presence encouraged other Japanese banks to take part in a movement which helped drive down CLO triple A spreads. The impact was clear as European CLO triple As went from 150 basis points in January 2016 to just 96bp in December.

The Tokyo-based firm is the largest CLO investor in the world, but sources say it has stepped away from the market for almost a year.

Points up front

A mover and Shaker

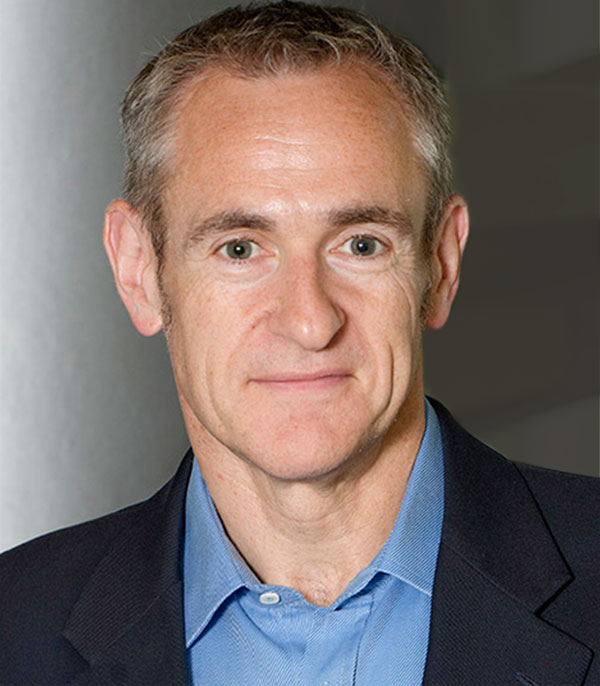

Veteran CLO portfolio manager Matthew Miller has stepped away from the industry after two decades to indulge in his passion for antiques crafted by the Shaker community.

“I became interested in their craftsmanship, business acumen and progressive views on both gender and racial equality,” he says. This resulted in the launch of Miller Wertheim Antiques

(www.millerwertheimantiques.com).

We asked the ex-Crescent Capital official whether there were any skills he picked up in the CLO industry which would be useful in his new venture and he said: “You wake up every day, bang the drum (no matter how little anyone cares), be honest and pay attention to the details. The rest will take care of itself.”

We think Miller will enjoy reviving antiques — although maybe not quite as much as resetting a legacy CLO.

Legacy deal: Matthew Miller is quitting CLOs to become a chair-man

Acting credit award

CLO types are clearly multi-talented. We learned this month that Vibrant Capital’s co-chief investment officer Kashyap Arora has a special claim to fame having starred as the lead in comedy/drama Silicon Jungle, which was produced by his university in India (see Q&A).

As it happens, at Creditflux we’ve been developing a script for a CLO-themed action thriller about a portfolio manager who has to defy the odds to print a deal in a race against time. We’re calling it Refi Another Day.

THEY SAID IT

“I am extraordinarily proud of the firm I have helped build”

Apollo chief executive officer Leon Black announces he is stepping down. “Given the extraordinary strength and depth of Apollo’s management team and consistent with best-in-class governance practices, I have advised the Apollo board that I will retire as CEO on or before my 70th birthday in July and remain as chairman,” he said.

Prev article

CLOs at a glance

Next article

The tide has turned… the solution for investors is to move into floating rate loans

Global credit funds & CLO's

February 2021

| Issue 231Published in London & New York.

Copyright Creditflux. All rights reserved. Check our Privacy Policy and our Terms of Use.